|

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

• To gather and analyse economical and statistical data related to forging, casting, mold-making and prototyping activities, at national and international levels

• To deliver truthful performance analysis and forecasts, by production technology, by alloy category, by market segment…

• To build and maintain quantitative databases allowing for a regular follow-up or key indicators to our profession; to complete dashboards for the working groups put in place by the Federation and its members

• To address our company members’ requests for documentation on foreign macroeconomic data

• To lead working groups dedicated to technologies, markets

• To define and initiate collective research projects to be carried out with forging and casting technical centers

• To relay information and actions implemented by the European organization for forging, casting, molds and prototyping

• To participate as a full partner in collective actions related to energy and raw materials

• To assist our member companies in the implementation of their recruitment policy by giving more visibility to their job offers, encouraging job placement for young graduates and animating a working group dedicated to human resources management

• To ensure a balance between qualification requirements and training programs through permanent dialogue with and between various training institutions

• To help our member companies to implement the collaboration agreements signed with the Ministry of National Education

• Deliver technical advice to our member companies on issues related to their activity: seek for suppliers, technical surveys and reports, technological alternatives…

• To relay customer sectors’ requests for quotation to our company members

• To lead thematic commissions on maintenance, production, security… at production sites

• To monitor regulatory and technological changes

• To take part in national and European research projects, to lead collective actions for energy and process efficiency progress

• To coordinate specialists and academic staff’s contributions to La Revue Forge Fonderie, relying on an extensive network of researchers from France and Europe

• To ensure and enhance the public visibility of our profession and members, also with client sectors

• To make available various communication supports in order to project a consistent and positive image of our jobs and careers, and highlight the major contribution of our members’ activity to various industries

• To assist and represent our members at key tradeshows to their activity

• To design and publish the Revue Forge Fonderie

• To train our member companies and raise their awareness about essential legal reflexes for them to secure their business activity

• To assist them in the study and defence of their rights and interests

• To inform them of the latest regulatory, judicial and policy changes which can impact their business activities

• To represent them before public authorities and client sectors (by leading commissions) on tax, legal and contractual issues

• To pilot updates and changes in all standard-form contracts used by European foundries and forging companies

• To lead a think tank for and with our members and partners on the challenges and impacts of digitalisation on forging, casting and prototyping industries; to explain the strategic stakes of these changes during working sessions, sites visits, conferences

• To allow our member companies executives to enhance their strategic vision while taking fully into account these impacts of digitalization

• To promote the interests of the profession by taking a direct part in drafting the new regulatory texts through working groups led by the French Ministry of Environment

• To guide our members through the implementation of new regulatory changes in their production sites, thanks to our industrial expertise

• To pass on to our members useful and relevant information related to EHS issues: new regulatory contents, new industry guides, best practice exchanges, participation in themed events (guest speakers, sites visits…)

• To lead an efficient network of professionals in EHS so that it can benefit to our members, in particular through the Environment Commission that consists in EHS managers who share their work on thematic issues

| News |

|

|

March 26 2025

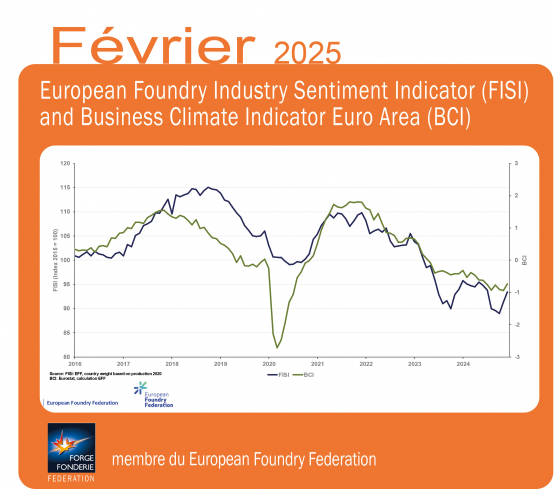

European Foundry Industry Sentiment Indicator (FISI) marks an increase in February 2025

February 2025 was the second month in a row, which displayed delicate signs that the situation of the European foundry industry is beginning to improve. The European Foundry Industry Sentiment Indicator (FISI), conducted monthly by the European Foundry Federation, shows signs of a slight economic recovery. Compared to the data from January 2025, the FISI increased from 91.3 to 93.4. This does not mean an automatic, sudden, certain and dynamic economic growth in the upcoming months, yet these are the first signs that the European foundry industry is slowly recovering after an exceptionally difficult year 2024, when the FISI index value fell every month – from 96.2 in January to 89.0 in December 2024. This rise suggests a slight improvement in the industry’s outlook, moving closer to the neutral 100-point mark. This development is partly due to positive expectations for the second half of 2025, as businesses anticipate potential growth and stabilization in demand. At the same time, in February 2025, the Business Climate Indicator (BCI), an index published by European Commission increased from ‑0.94 in January to ‑0.74 and according to the latest news, the euro zone’s GDP growth is expected to increase by +1.4% in 2025, up slightly from +0.7% in 2024.

The latest data shows a normalization of the situation in the eurozone’s manufacturing sector. The eurozone manufacturing Purchasing Managers’ Index (PMI) rose to 47.6 in February 2025, from 46.6 in January and from 45.1 in December, almost approaching the 50-point threshold that separates growth from contraction. Purchasing Managers’ Index (PMI) in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. Geopolitical events, those of recent weeks, months and years, have caused revolutions in most industries in Europe. In the foundry industry, it began with a drastic increase in the prices of materials and energy, and declines in production in almost every EU country. Now, the diversification of foundry production is increasingly noticeable. Due to the geopolitical situation, the arms industry and energy industry — which have always been significant recipients of castings — are gaining importance.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice