| 7,5 billion € turnover |

35 920 people |

1,870 million tons |

403 production sites |

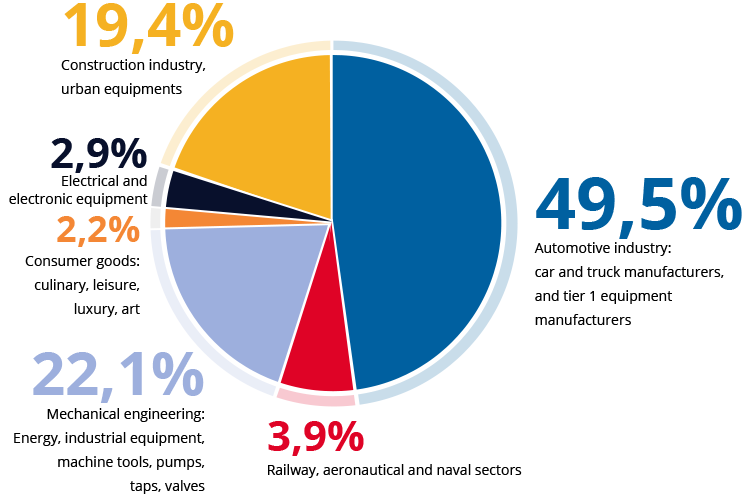

(in volume)

|

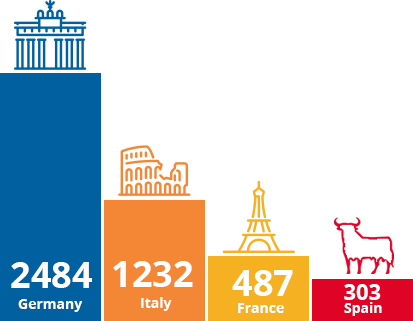

European ranking (Turkey included) by countries for Casting

|

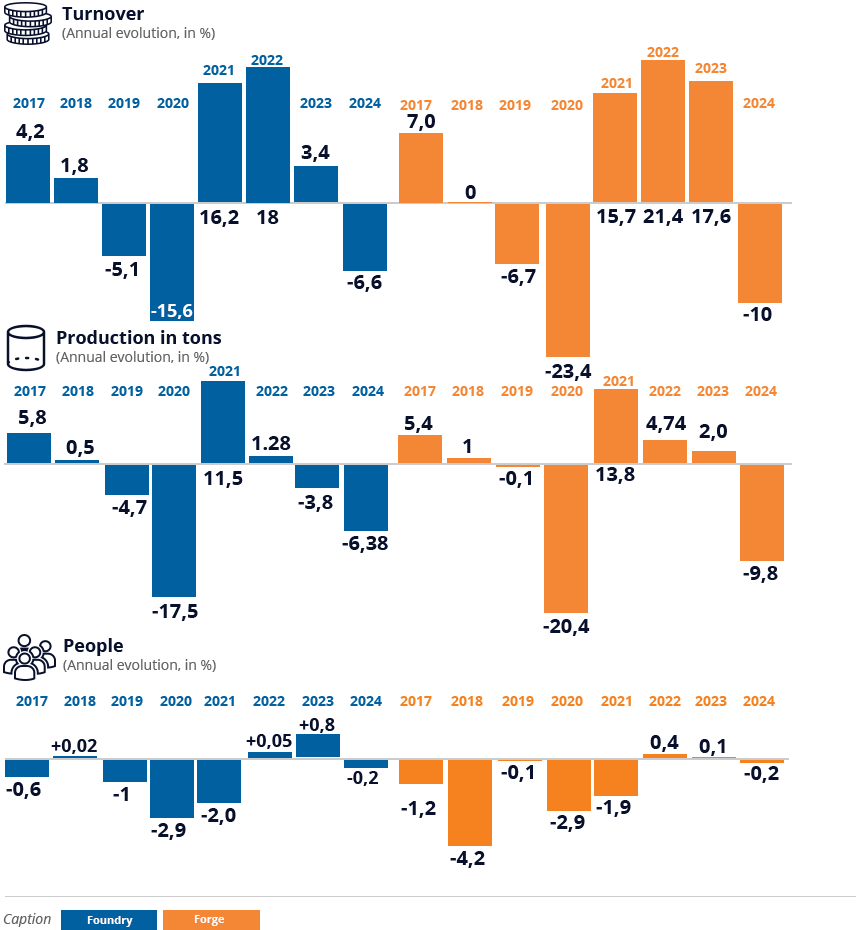

Forging production

|

| 5,7 billion € turnover |

28 507 people |

1,423 million tons de produits |

330 production sites |

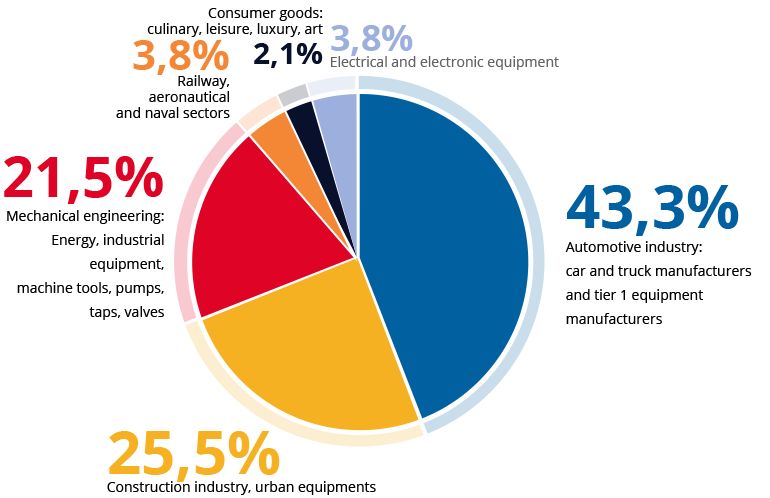

(% of turnover)

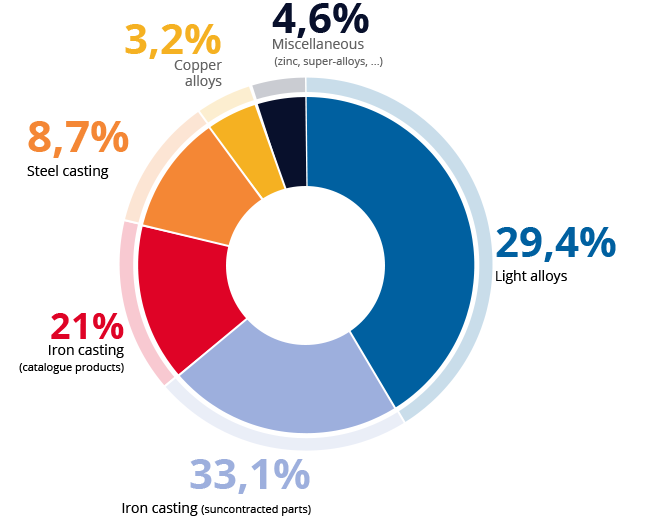

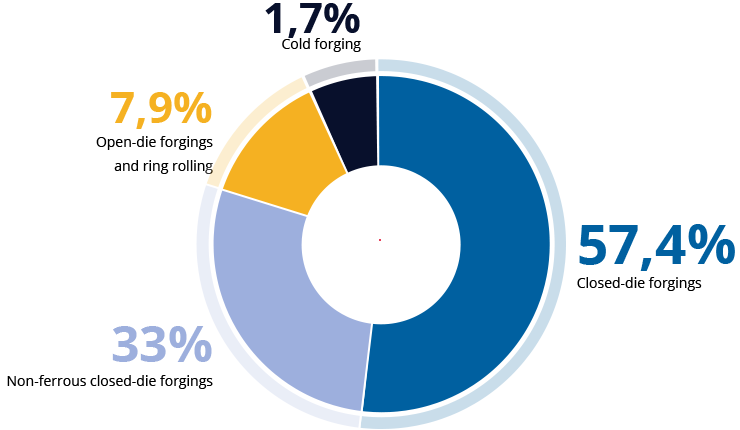

(% of tonnage)

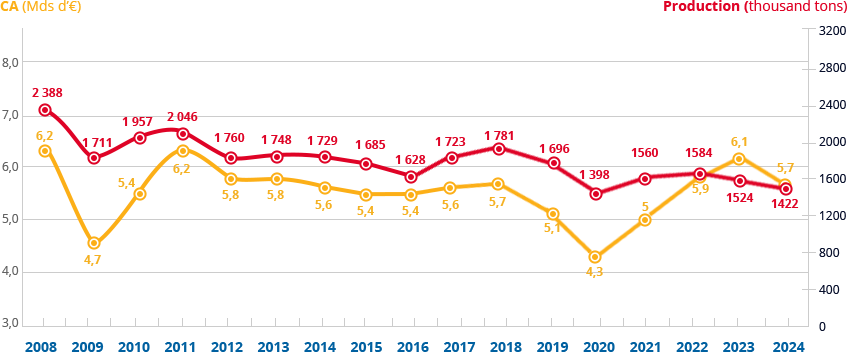

(billion € and thousand tons)

| 1,8 billion € turnover |

7 413 people |

447 thousand tons |

73 production sites |

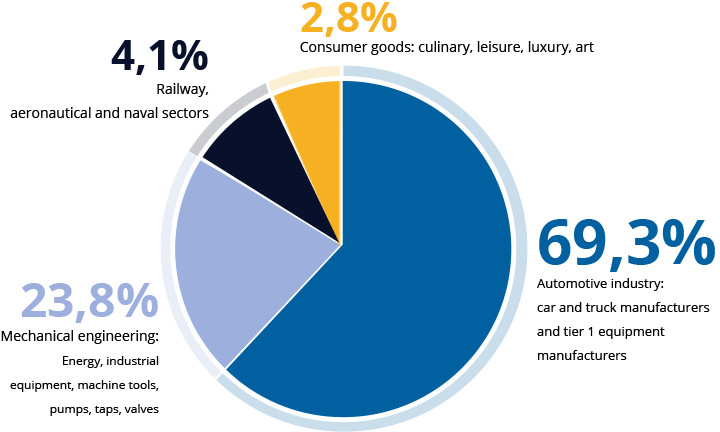

(% of turnover)

(% of tonnage)

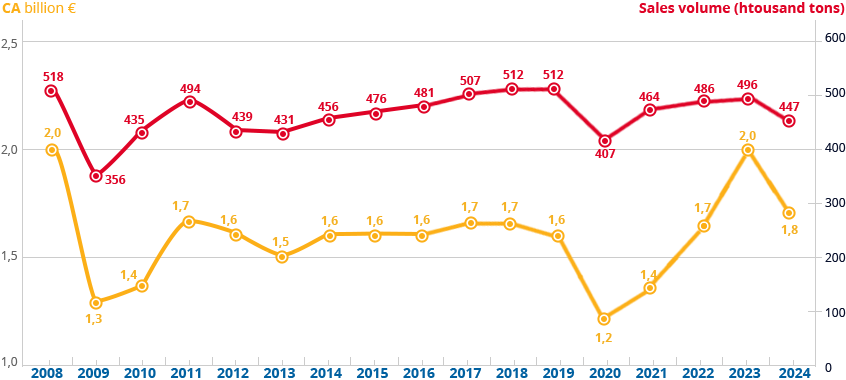

(billion € and thousand tons)

| News |

|

|

January 15 2026

La nouvelle édition est disponible !

L’expertise et l’actualité de la profession Forge & Fonderie

Téléchargement gratuit ICI ou commande de la version papier ICI EDITORIAL L’année du courage et du retour au bon sens ? Wilfrid BOYAULT BREVES Fatigue Design La Fédération Forge Fonderie participe à Global Industrie Paris TECHNIQUE Le magnésium pour les applications spatiales Patrick HAIRY, Michel STUCKY, David MIOT-POLETTI et Thibaut BOUILLY Recyclabilite du ZAMAK dans les emballages Clotilde MACKE-BART ENVIRONNEMENT Défis et opportunités de l’électrification dans les forges et les fonderies Charlotte MOUGEOT MARCHÉ La relance mondiale de l’énergie nucléaire : des promesses au réalisme Guillaume KOZUBSKI FORMATION À la rencontre des jeunes talents de la fonderie Sergio DA ROCHA Organisation du Concours « Un des Meilleurs Ouvriers de France » Fonderie d’Art Sergio DA ROCHA ÉVÉNEMENT EUROFORGE : 24. International Forging Congress Olivier VASSEUR AGENDA Les rendez-vous de la profession |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice