Rencontrez la Fédération Forge Fonderie et nos adhérents sur GLOBAL INDUSTRIE - MIDEST`

Le salon GLOBAL INDUSTRIE ouvrira ses portes du 23 au 26 Juin 2020

A cette occasion, venez rencontrer nos adhérents exposants. Voici la liste des adhérents déjà inscrits :

| Nom d'entreprise | Activité | Numéro stand | Région | Département |

| AB FONDERIE | Fonderie | Hall 6 Stand 6F92 | Auvergne Rhône Alpes | 69 |

| BOURGUIGNON BARRE | Forge | Hall 6 Stand 6G97 | Grand Est | 8 |

| DECAYEUX STI | Forge | Hall 6 Stand 6J105 | Hauts-de-Seine | 80 |

| FAVI | Fonderie | Hall 6 Stand 6H111 | Hauts-de-Seine | 80 |

| FONDERIE BARBAS ET PLAILLY | Fonderie | Hall 6 Stand 6J111 | Centre Val de Loire | 41 |

| FONDERIE GIROUD INDUSTRIE | Fonderie | Hall 6 Stand 6H103 | Auvergne Rhône Alpes | 38 |

| FONDERIE NOWAK / NOWAK INVESTMENT | Fonderie | Hall 6 Stand 6F104 | Pays de la Loire | 35 |

| FONDERIES DECHAUMONT | Fonderie | Hall 6 Stand 6G111 | Occitanie | 31 |

| FONTREY | Fonderie | Hall 6 Stand 6G96 | Centre Val de Loire | 42 |

| INOXYDA | Fonderie | Hall 6 Stand 6H105 | Normandie | 76 |

| LBI FOUNDRIES | Fonderie | Hall 6 Stand 6H105 | Grand Est | 57 |

| OMP FONDERIE ZAMAK | Fonderie | Hall 6 Stand 6F111 | Auvergne Rhône Alpes | 1 |

| PRECICAST FRANCE | Fonderie | Hall 6 Stand 6J111 | Centre Val de Loire | 41 |

| PRECIFORGE | Forge | Hall 6 Stand 6G97 | Auvergne Rhône Alpes | 63 |

| STEVENIN NOLLEVAUX | Forge | Hall 6 Stand 6F105 | Grand Est | 8 |

|

|

UN ÉVÈNEMENT QUI RÉUNIT :

- tout l'écosystème industriel (start'ups, offreurs de produits/solutions, équipementiers, sous-traitants, donneurs d'ordres, grands groupes)

- toute la chaîne de valeur (recherche & innovation, conception, production, services, formation)

- toutes les filières utilisatrices (transports & mobilité, énergies, infrastructures, agroalimentaire, biens de consommation, chimie, cosmétologie, pharmacie, mécanique, défense, militaire, métallurgie, sidérurgie)

| News |

|

|

March 26 2025

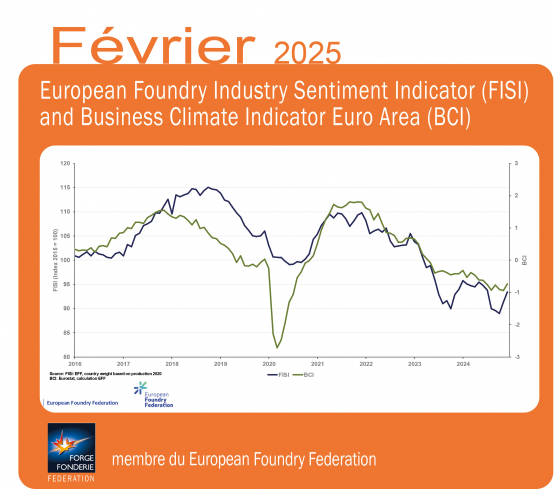

European Foundry Industry Sentiment Indicator (FISI) marks an increase in February 2025

February 2025 was the second month in a row, which displayed delicate signs that the situation of the European foundry industry is beginning to improve. The European Foundry Industry Sentiment Indicator (FISI), conducted monthly by the European Foundry Federation, shows signs of a slight economic recovery. Compared to the data from January 2025, the FISI increased from 91.3 to 93.4. This does not mean an automatic, sudden, certain and dynamic economic growth in the upcoming months, yet these are the first signs that the European foundry industry is slowly recovering after an exceptionally difficult year 2024, when the FISI index value fell every month – from 96.2 in January to 89.0 in December 2024. This rise suggests a slight improvement in the industry’s outlook, moving closer to the neutral 100-point mark. This development is partly due to positive expectations for the second half of 2025, as businesses anticipate potential growth and stabilization in demand. At the same time, in February 2025, the Business Climate Indicator (BCI), an index published by European Commission increased from ‑0.94 in January to ‑0.74 and according to the latest news, the euro zone’s GDP growth is expected to increase by +1.4% in 2025, up slightly from +0.7% in 2024.

The latest data shows a normalization of the situation in the eurozone’s manufacturing sector. The eurozone manufacturing Purchasing Managers’ Index (PMI) rose to 47.6 in February 2025, from 46.6 in January and from 45.1 in December, almost approaching the 50-point threshold that separates growth from contraction. Purchasing Managers’ Index (PMI) in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. Geopolitical events, those of recent weeks, months and years, have caused revolutions in most industries in Europe. In the foundry industry, it began with a drastic increase in the prices of materials and energy, and declines in production in almost every EU country. Now, the diversification of foundry production is increasingly noticeable. Due to the geopolitical situation, the arms industry and energy industry — which have always been significant recipients of castings — are gaining importance.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice