Pour cette troisième édition depuis sa création en 2018, la Fédération Forge Fonderie est partenaire de Castforge pour réunir sur un « Village Forge et Fonderie » une trentaine de forges et fonderies françaises qui exposeront à Stuttgart du 4 au 6 juin 2024.

Seront également présents, dans le Bade‐Wurtemberg, région à la longue tradition de sous-traitance industrielle, nos voisins et amis européens ainsi que le CAEF, devenu EFF (European Foundry Federation), et EUROFORGE.

Soyez, vous aussi, au rendez‐vous de Stuttgart en juin prochain.

CastForge | Messe Stuttgart (messe-stuttgart.de)

Nos adhérents au village forge et fonderie

BAM - Business Alu Masué - Stand : 3D19

Contifonte - Stand : 3D13

Ferry Capitain - Stand : 3F18

Fonderie Rapide Belfortaine - Stand : 3E15

Fontrey - Stand : 3F12

OMP Fonderie - Stand : 3F16

PTP Industrie - Stand : 3E18

Saint Gobain Seva - Stand : 3D15

Setforge - Stand : 3E19

Société Industrielle des Fontes (S.I.F) - Stand : 3E17

VHM Heinrich Fonderie - Stand : 3E14

Zwiebel - Stand : 3E12

Nos adhérents hors village forge et fonderie

Bourguignon Barré - Stand : 3C77

Brousseval et Montreuil - Stand : 5C11

La Fonte Ardennaise LFA - Stand : 5B14

LBI - Les Bronzes d'Industrie - Stand : 3C61

Manquillet Parizel - Stand : 3A54

Préciforge - Stand : 3C75

Schlumberger - Stand : 5B53

Sifcor Groupe - Stand : 3F52

Walor - Stand : 5C51

| News |

|

|

March 26 2025

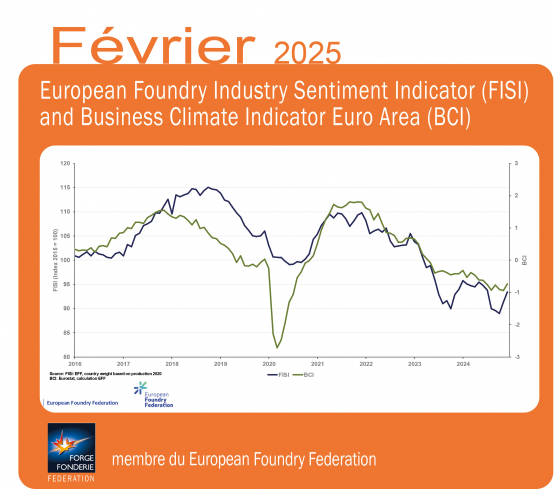

European Foundry Industry Sentiment Indicator (FISI) marks an increase in February 2025

February 2025 was the second month in a row, which displayed delicate signs that the situation of the European foundry industry is beginning to improve. The European Foundry Industry Sentiment Indicator (FISI), conducted monthly by the European Foundry Federation, shows signs of a slight economic recovery. Compared to the data from January 2025, the FISI increased from 91.3 to 93.4. This does not mean an automatic, sudden, certain and dynamic economic growth in the upcoming months, yet these are the first signs that the European foundry industry is slowly recovering after an exceptionally difficult year 2024, when the FISI index value fell every month – from 96.2 in January to 89.0 in December 2024. This rise suggests a slight improvement in the industry’s outlook, moving closer to the neutral 100-point mark. This development is partly due to positive expectations for the second half of 2025, as businesses anticipate potential growth and stabilization in demand. At the same time, in February 2025, the Business Climate Indicator (BCI), an index published by European Commission increased from ‑0.94 in January to ‑0.74 and according to the latest news, the euro zone’s GDP growth is expected to increase by +1.4% in 2025, up slightly from +0.7% in 2024.

The latest data shows a normalization of the situation in the eurozone’s manufacturing sector. The eurozone manufacturing Purchasing Managers’ Index (PMI) rose to 47.6 in February 2025, from 46.6 in January and from 45.1 in December, almost approaching the 50-point threshold that separates growth from contraction. Purchasing Managers’ Index (PMI) in the Euro area is an indicator of the economic health of the manufacturing sector. It is based on such indicators as: new orders, inventory levels, production, supplier deliveries and the employment environment. Geopolitical events, those of recent weeks, months and years, have caused revolutions in most industries in Europe. In the foundry industry, it began with a drastic increase in the prices of materials and energy, and declines in production in almost every EU country. Now, the diversification of foundry production is increasingly noticeable. Due to the geopolitical situation, the arms industry and energy industry — which have always been significant recipients of castings — are gaining importance.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by CAEF the European Foundry Association every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months. The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations. |

| Read more |

| Directory |  |

| Forge Fonderie Magazine |

|

| Indicators |  |

| Press Room |  |

| Join us |  |

© 2016 Fédération Forge Fonderie - Credits & legal notice